In 2023, employers and employees faced an unsteady environment, with tension from return-to-office plans, talent shortages, and budgetary constraints.

In 2024, we will continue to face similar challenges:

- An ongoing adjustment to this post-pandemic “new normal”

- A persistent and widening gap between the supply and demand of qualified, top-tier accounting and finance talent

- And the pressure to control costs (at home and at work)

The following 5 workplace trends (supported by multiple research sources) highlight what you can expect for 2024.

1. Jobs Boomed… Then, Braked Hard

![]()

Fueled by pandemic snapback, strong consumer demand drove robust hiring in most of 2021 and 2022. And despite supply chain turmoil and spiking prices, companies still scrambled to staff up.

Around mid-2022, inflation peaked at a record-high 9.1%, and in response, the Federal Reserve began raising interest rates. By late 2023, hiring had slammed the brakes in many sectors.

Still, a sort of stability is taking shape in 2024.

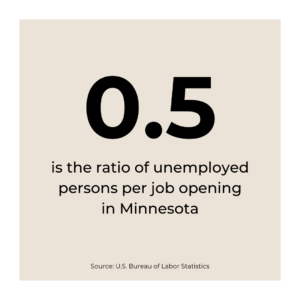

Job openings in Minnesota are double the number of unemployed people looking for work, indicating strong labor demand. And while layoffs ticked up last fall, widespread downsizing did not occur, suggesting the labor market remains relatively resilient.

2. The Growing Role of AI and Automation

![]()

AI and automation gained significant attention in 2023 across social media, news outlets, and more. Our AMBRION team anticipates these technologies will continue to be a hot topic in 2024 and beyond.

How accounting and finance professionals can fully leverage these tools is not crystal clear (yet), but some key uses have started to take shape:

- Assists with writing standardized footnotes and disclosures

- Supports streamlining of financial reporting processes by putting together 10-K and 10-Q analysis and filings, decreasing work hours previously required

- Early adoption focuses on repetitive, rules-based tasks that are time-intensive for humans but well-suited for AI and automation. This allows professionals to devote time to higher-value analysis and strategic work.

As capabilities advance, AI and automation are expected to play an increasing role in enhancing workflows in accounting and finance. However, thoughtful integration will be key to balancing efficiency gains with sound human oversight.

The potential to transform workflows through positive disruption remains high.

3. Work Location Preferences

![]()

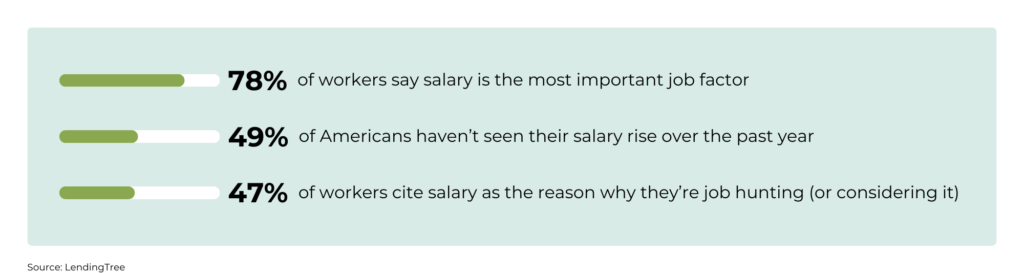

Flexible work options will continue to be a top priority for workers in 2024, with over half of remote-capable employees preferring hybrid work – according to research from Gallup.

Another poll by Monster revealed that 41% of workers would rather quit than return to in-office work full-time. In a time where inflation is outpacing pay increases, that statistic speaks volumes.

“Organizations that provide increased options for where and when work gets done will have strategic advantages in attracting and retaining qualified talent,” notes industry thought leader Katie Kelly. She adds, “Along with benefiting employees, flexible work models can yield cost savings from reduced office space needs and create opportunities for leaders to drive sustainable success in 2024’s evolving market.”

4. The Gap Between Talent Supply and Demand is Widening

![]()

The latest projections from the Bureau of Labor Statistics indicate a growing need for accounting and finance professionals from 2022-2032:

- 4% growth in employment for accountants and auditors

- 16% growth in employment for financial managers (faster than the average for all occupations)

However, this rise in demand is more than new college graduates can replace, further widening the existing talent gap.

Since 2015, the number of students who graduated with a bachelor’s degree in accounting has steadily decreased by 1-3% each year. This trend intensified in 2021–2022 with almost an 8% drop. On a local level, the share of graduates with accounting degrees at the University of Minnesota’s Carlson School of Management fell from 19% in 2019 to 17% in 2022.

Even though market fluctuations and talent shortages are beyond our control, leaders can still be the employer of choice by enhancing recruitment and hiring strategies.

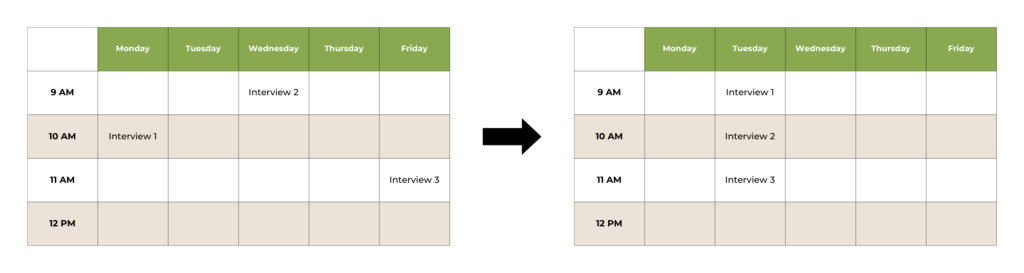

Actionable Tip for Better Hiring: To attract and hire top-tier talent in 2024, hiring teams should move quickly. Timing is everything when landing candidates, as their “shelf life” is limited due to high demand. Schedule interview rounds back-to-back vs. spreading them across multiple days to maximize efficiency and maintain a comprehensive evaluation.

5. Compensation Remains a Key Motivator

![]()

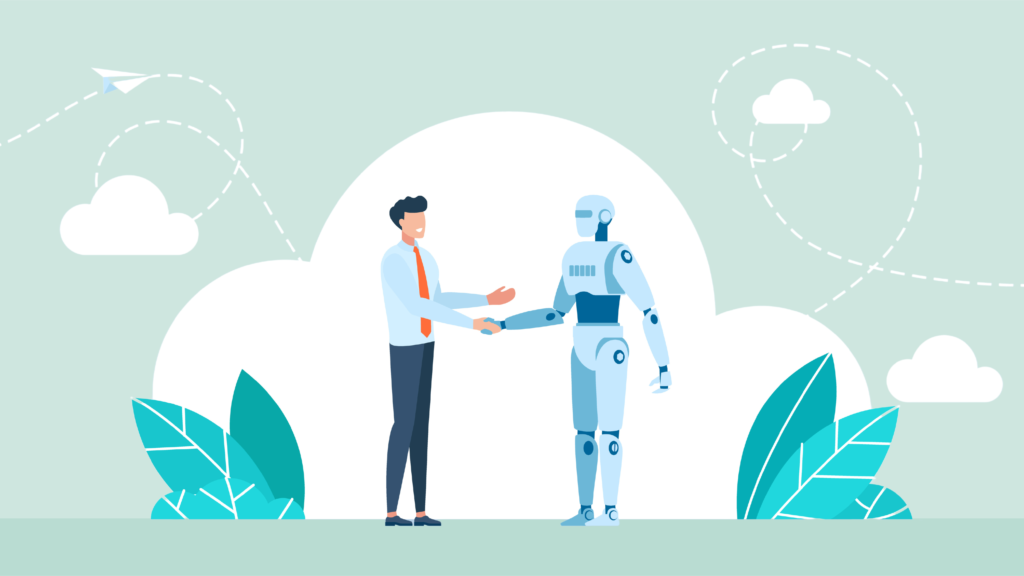

After several years of robust wage growth, salary increases in accounting and finance are projected to moderate in 2024 and beyond. The latest data forecasts average national pay growth of 3.8% this year – a slight decline from 4-5% in 2022-2023, signaling a stabilizing market.

However, with lingering high inflation, many employees still hope for more compensation.

Actionable Tip for Better Hiring: Don’t rule out competitive offers in 2024. So long as employers continue competing for accounting and finance talent, they’ll need strategic compensation strategies, benchmarking, and compelling total packages to help secure qualified talent in 2024’s shifting landscape.

Final Thoughts

![]()

As we jump into 2024, the Twin Cities market remains promising, particularly in the accounting and finance sectors. So whether you’re looking to fill an open position or are curious about the latest local market trends, we’re here to help.

Connect with us today and discover the difference our collective expertise can make for you and your organization!