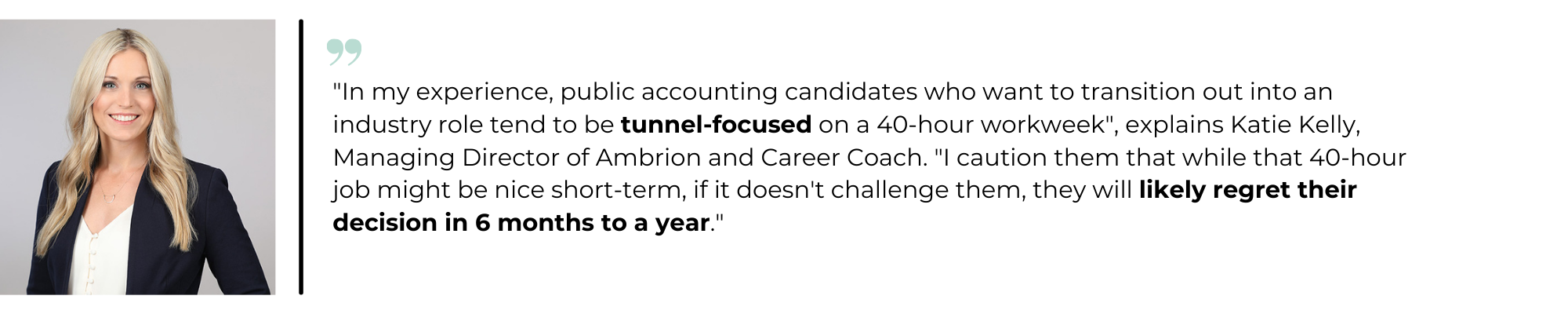

You’ve been grinding away in public accounting for a while, honing your skills and building your reputation. But lately, you’ve felt a nagging sense that it might be time for a change. Maybe you’re craving more work-life balance, or perhaps you’re eager to tackle new challenges. But how do you know when it’s really time to leave public accounting? And what should you do next?

In this blog, we’ll explore:

- 6 common reasons why people leave public accounting

- What to look for in an industry accounting or finance role

- The importance of taking your blinders off when exploring opportunities

- How to make a graceful exit without burning bridges

Let’s do it.

How Do I Know When It’s Time To Leave Public Accounting?

![]()

You’re Feeling Intense + Constant Burnout

The demands of busy season are an expected and unavoidable part of public accounting. BUT there’s a difference between occasional intensity and persistent overwhelm. When burnout is a constant companion and your personal life consistently takes a backseat, it’s probably time to explore other options. Many who make the leap to industry find they still enjoy challenging work and meaningful growth but with a rhythm that allows them to build a life beyond spreadsheets.

The Passion Has Faded

Remember your first few months as a public accountant, when you’d feel excited about diving into new clients and learning different industries and business models?

- Does it still feel like that?

- Or do you feel like you’re just going through the motions lately?

A bad day (or week, or busy season) happens to everyone. That’s normal. But if you’re hitting snooze five times every morning and Sunday nights fill you with dread, your gut might be telling you something.

The Partner Track Doesn’t Sound Appealing

Look at the partners at your firm. Really look at their day-to-day reality, not just the title and compensation. Does that life appeal to you? If you’re thinking, “That’s not what I want my life to look like,” that’s valuable information. With only about 2% of public accountants reaching the partner level, most will transition elsewhere eventually. The question becomes not if but when.

Your Career Goals Don’t Align Anymore

After one busy season, you may desire broader horizons beyond public accounting. You may be drawn to hands-on accounting, reporting, or even forecasting. Ask yourself: Do I want more variety in my current job, or am I ready for a new career direction? Your answer will reveal your best path forward.

More Consistency Sounds Kind of Nice

Some accountants thrive on the variety and excitement of tackling new accounts every few months. But maybe you find that experience jarring, and the thought of sticking with one company long-term sounds like it’d be more enjoyable.

In an industry accounting role, you’re more likely to experience the gratification of:

- Leading a system implementation project from start to finish

- Developing processes that stick around (and that people thank you for!)

- Seeing your contributions shape the company’s growth year after year

You Missed Out on a Promotion You Wanted

Getting passed over for a promotion can be a big disappointment. But as frustrating as it is, try to see this setback as a chance to rethink your career journey. Use it as motivation to look for new opportunities elsewhere that will value your skills and help you grow. Just because you aren’t promoted in public accounting doesn’t mean that you can’t have that path in an industry role.

Don’t let one closed door make you doubt yourself or stop your career progress. Instead, let it push you to find a place that will invest in your growth and recognize your worth.

What To Look For in an Industry Accounting Role

![]()

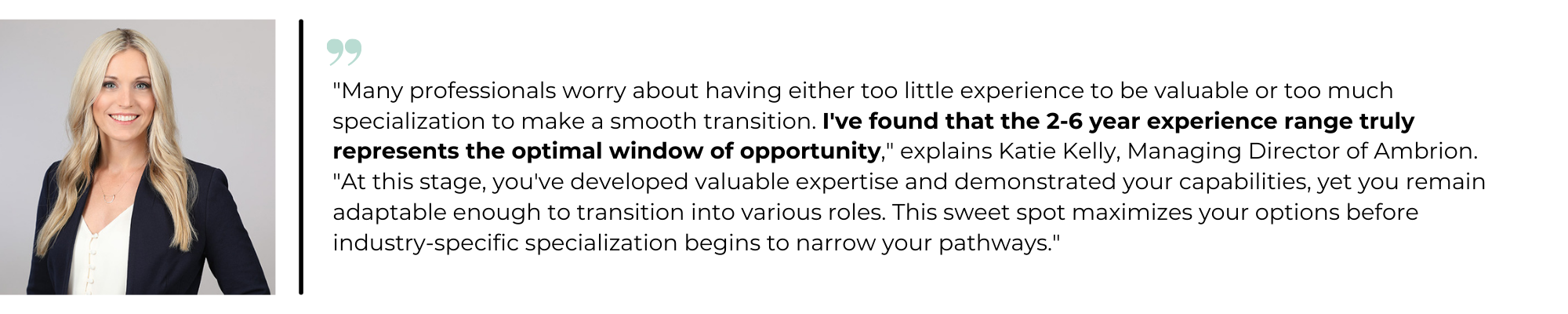

The Right Balance of Hours vs. Fulfilling Work

Public accounting is like a sprint – hustling fast nonstop. In comparison, some industry accounting jobs are like a slow walk – 40 hours/week consistently and a routine cadence of the same tasks each week. Going from a sprint to a slow walk sounds nice when you’re burnt out, but if you don’t feel challenged, you’ll get bored and find yourself looking for a new job again.

This doesn’t mean you should settle for a role that leaves you overworked and stressed. Instead, focus on finding a position with periodic bursts of busyness instead of perpetual ones and opportunities to learn, grow, and challenge yourself.

Think about the hours you put into a job. Do they equate to the career growth that you want to have? As an example – let’s say a job opportunity requires 50-55 hours of work each week. But, the work you’d be doing is something you’re passionate about (ex: building a new skill) and is more than just auditing. You might be OK investing your time in that situation.

Leaders Who Will Invest in Your Growth

During interviews, get to know the leadership team you’d be working with. Great leaders care about developing their people, not just hitting quarterly targets.

Questions that can reveal leadership quality:

|

|

Look for leaders who give specific examples rather than generic answers. The best ones light up when talking about their team members’ growth and can share concrete stories about developing talent.

A Passion for the Product or Service

We spend too many hours at work not to care about what we’re doing. Whether it’s a company mission that resonates with your values or an industry that genuinely interests you, finding meaning makes even challenging days more fulfilling. During interviews, notice how people talk about their work. Are they going through the motions or seem genuinely invested in what they’re building? That enthusiasm gap tells you volumes about what your experience might be like.

Company Culture, Growth, Reputation

When considering a new job, look beyond the role itself and evaluate the company’s culture, growth trajectory, and industry reputation. These factors can make a big difference in how happy you are at work and how far you can go in your career. A good company can open doors to exciting opportunities, while a subpar one can hold you back.

Here are some key things to think about:

|

|

As you research potential employers, watch for red flags like high turnover, lack of diversity, or negative employee reviews. Reach out to people in your network (including your favorite recruiter!) with firsthand experience for their candid insights into the company.

How To Leave Public Accounting Without Burning Bridges

![]()

The Twin Cities accounting community is smaller than you might think. You never know when you might bump into a former colleague or need a reference from your prior employer!

Here’s how to leave on good terms:

Have The Conversation (Even Though It’s Awkward)

Telling your manager you’re leaving isn’t easy. It can feel nerve-wracking and uncomfortable – especially if they’ve invested in your development. But handling this conversation with care sets the tone for your entire departure.

Try this approach:

|

|

If you’re leaving during busy season or in the middle of a critical client engagement, acknowledge it upfront. Discuss how to handle the timing in a way that doesn’t leave the team scrambling. Your manager will remember and appreciate this professional courtesy after you’ve gone.

Leave A Positive Last Impression

Your final weeks are about wrapping up work AND cementing connections that could benefit you for years. Create clear (and detailed) handoff documents, Grab coffee with mentors who’ve shaped your professional journey, and make sure all your files are organized and properly documented.

Say Thank You, Specifically

Generic goodbyes fade quickly. Take time to write personalized notes to those who’ve made a difference.

Here’s an example:

| “Susan, your patient guidance during ABC Company’s audit completely changed how I approach financial statement analysis. I still hear your voice in my head asking the right questions when I’m reviewing complex transactions. Thank you for investing that time in me.” |

These specific acknowledgments show emotional intelligence (EQ) and make people feel truly seen and valued. They transform colleagues into connections that can last well beyond your time at the firm.

Final Thoughts

![]()

Deciding if and when to leave public accounting is never easy. What’s important is to continuously evaluate what matters to you and your long-term career goals. Having a mentor and your favorite recruiter in your corner can help you assess when the time is right.

You are in charge of your career. Put yourself in a prime position to take advantage of the best opportunities!

Related Blogs You’ll Enjoy:

![]()

- 12 Reasons to Connect with a Recruiter

- How to Update Your Resume [5 Tips + Examples]

- 10 Interview Tips to Land Your Dream Job